Gross up pay calculator

When you calculate take-home pay for your employees you typically take their gross salary which consists of. Heres How Much Car You Can Afford Follow the 35 Rule.

Avanti Gross Salary Calculator

You print and distribute paychecks to employees.

. Free calculator to find the actual paycheck amount taken home after taxes and deductions from salary or to learn more about income tax in the US. The bonus can be paid with a separate 300 check as retro pay. Gross Profit Margin can be calculated by using Gross Profit Margin Formula as follows Gross Profit Margin Formula Net Sales-Cost of Raw Materials Net Sales Gross Profit Margin 100000- 35000 100000 Gross Profit Margin 65.

Start with the employees gross pay. An hourly or nonexempt employee is paid by the hours worked times the agreed-upon hourly. You populate file and remit payment for your annual and quarterly taxes.

To determine net pay gross pay is computed based on how an employee is classified by the organization. 4Up to 2000yr free per child to help with childcare costs. Fill the weeks and hours sections as desired to get your personnal net income.

Estimated Gross Rental Income Property Price Gross Rent. Deposit income tax BEFORE discounts 15 from 35 000 CZK. 2Transfer unused allowance to your spouse.

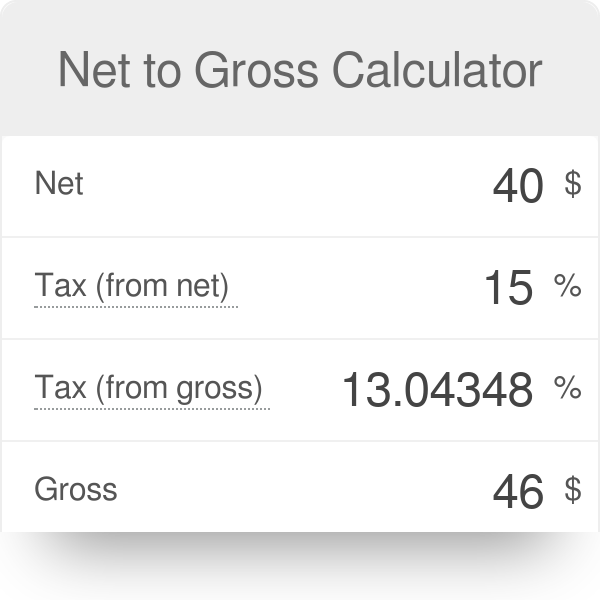

The gross price would be 40 25 40 10 50. You perform a job and your gross pay is 50. You rest assured knowing that all tax calculations are accurate and up to date.

At the same time more leading roles like Software Architect Team Lead Tech Lead or Engineering Manager can bring you a gross annual income of kr 850000 without bonuses. 3Reduce tax if you wearwore a uniform. Your gross annual rental income would be 2000 x 5 units x 12 months 120000.

Start by subtracting any pre-tax deductions offered by the business. Free tax code calculator. At the same time more leading roles like Software Architect Team Lead Tech Lead or Engineering Manager can bring you a gross annual income of 43000 without bonuses.

Estimated Property Price 120000 x 5 units 600000. That means if you make 36000 a year the car price shouldnt exceed 12600. Under the W-4 Form Information section indicate whether or not you have filed a W-4 Form for 2020 or later and complete the W-4 Form fields that apply.

Gross profit margin is your profit divided by revenue the raw amount of money madeNet profit margin is profit minus the price of all other expenses rent wages taxes etc divided by revenue. Gross-Up Calculator Plus Net to Gross Pay Instructions. This calculator uses the redesigned W-4 created to comply with the elimination of exemptions in the Tax Cuts and Jobs Act TCJA.

PaycheckCity produces annual and quarterly tax report data. Credit for tax payer. PaycheckCity populates and generates your paychecks.

The figures are imprecise and reflect the approximate salary range for tech. The figures are imprecise and reflect the approximate salary range. For example if an employee receives 500 in take-home pay this calculator can be used to calculate the gross amount that must be used when calculating payroll taxes.

First find your gross annual rental income and then input the income and GRM into the estimated property price formula. Net pay is the total amount of money that the employer pays in a paycheck to an employee after all required and voluntary deductions are made. Check your tax code - you may be owed 1000s.

Pay Periods and Interest Help. Gross pay calculator Plug in the amount of money youd like to take home each pay period and this calculator will tell you what your before-tax earnings need to be. It determines the amount of gross wages before taxes and deductions that are withheld given a specific.

Important Note on Calculator. For instance it is the form of income required on mortgage applications is. The employee earned a 300 bonus but did not receive the bonus on the pay period.

Think of it as the money that ends up in your pocket. We will then calculate the gross pay amount required to achieve your net paycheck. Net salary calculator from annual gross income in Ontario 2022.

Enter your gross wages and any claimed tips for the pay period then select your pay period the gross wages field is the only required field in the calculator. This gross-up calculator is designed to help you figure out how much you need to pay an employee if you want them to take home a specific amount of money after taxes are withheld. Tax rate up to 155 644 CZK monthly gross salary is 15.

Tax rate over 155 644 CZK monthly gross salary is 23. Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication 15T. This net income calculator provides an overview of an annual weekly or hourly wage based on annual gross income of 2022.

900-140 10th avenue se calgary ab T2g 0r1 careAVANTICA 1-800-660-0464. Now she has 65000 that can be used to pay for other indirect bills like utilities and rent. 27 overtime pay rate x three hours paid incorrectly 81 gross retro pay due Bonuses.

If this employee had zero deductions their gross pay and net pay would be the same. A minimum base salary for Software Developers DevOps QA and other tech professionals in Sweden starts at kr 160000 per year. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates.

You can see examples explaining this below. Whether youre paying cash leasing or financing a car your upper spending limit really shouldnt be a penny more than 35 of your gross annual income. While gross profit margin is a useful measure investors are more likely to look at your net profit margin as it shows.

Number of days in employees pay period Number of days between end of pay period and date that paychecks are issued First day of first pay period for which back pay is payable First day of last pay period for which back pay is payable Date on which back pay interest stops accruing Outside Earnings. A minimum base salary for Software Developers DevOps QA and other tech professionals in Portugal starts at 15000 per year. Net price is 40 gross price is 50 and the tax is 25.

Working mother with two children. This calculator is based on 2022 Ontario taxes. 5Take home over 500mth.

This calculator is for you. This is where the deductions begin. Use our net pay calculator to work out your monthly take-home pay as a contractor or permanent employee.

Need to start with an employees net after-tax pay and work your way back to gross pay. In this case well use the hourly employee from Table 1 whose gross pay for the week was 695. Earn 100 switching bank.

Use this federal gross pay calculator to gross up wages based on net pay. Enter gross income to calculate earnings after tax. The income tax is 20 so your net income is 50 - 20 50 - 10 40.

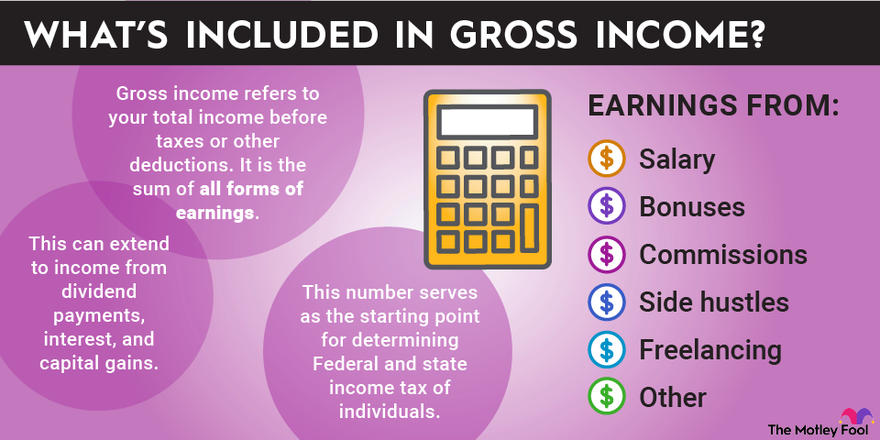

In the US the concept of personal income or salary usually references the before-tax amount called gross pay.

How To Calculate The Break Even Point Calculator Point Analysis

Gross Pay Is The Amount Of Wages Or Salary Paid By An Employer To An Employee Gross Pay Does Not Include Deductions Like Pay Calculator Paying Taxes Paying

How To Calculate Your Net Salary Using Excel Salary Excel Ads

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Payroll Calculator Templates 15 Free Docs Xlsx Pdf Payroll Template Payroll Payroll Checks

Net To Gross Calculator

How To Calculate Gross Income Per Month

Life Skills Reading And Writing Gross Pay Versus Net Pay Teaching Life Skills Life Skills Life Skills Class

How To Calculate What Percentage Of Gross Pay You Are Saving Monthly Investing Savings Account Saving

Income Tax Calculator App Concept Calculator App Tax App App

Avanti Gross Salary Calculator

Lending Vocab Cheat Sheet Conifer Realty Group Home Mortgage First Time Home Buyers Mortgage Tips

Back End Debt To Income Ratio Debt To Income Ratio Debt Ratio Debt

Payroll Calculator Templates 15 Free Docs Xlsx Pdf Payroll Template Payroll Templates

Python Program To Calculate Gross Pay In 2022 Python Programming Python Calculator

Rental Property Roi And Cap Rate Calculator And Comparison Etsy Rental Property Rental Property Management Income Property

Utah Income Tax Calculator Smartasset Income Tax Income Tax Return Federal Income Tax